Purchase and apply cannabis excise stamps to your products if you package cannabis products Calculate the duty on your sales. Stamp Duty is applicable on various documents including Property sale agreement and Leave and License rental agreement among others.

Gst Free And Non Reportable Ps Support

015 of amount of increase in authorised capital subject to maximum of rs.

. Thanks for explaining the relationship stamp duty and GST. Delhi companies not having share capital other than section 8 10. Stamp duty shall be.

Stamp Duty on LLP Agreement. The Maharashtra government in its budget for 2021-22 mentioned that stamp duty and registration charges in Maharashtra 2021 for female will be with a concession of 1 over the prevailing stamp duty in Maharashtra on property. Other than metal bearing sand fall under chapter 26 of the HSN code.

The Stamp Duty in Maharashtra is usually in the range of 4-7 of the consideration value mentioned in the. As per the Indian Penal Code not paying the required stamp duty is a criminal offence. File your monthly return and remit excise duty to the CRA.

Not only seller but also the buyer will be at loss if heshe agrees to buy makes agreement of at a value below the Stamp Duty Value because of the operation of Section 562XbAccording to the said section if the stamp duty value exceeds the purchase consideration by more than Rs50000 then the. In case of sale transfer or reissue. Seller transferor or issuer as the case may be shall be liable to pay stamp duty.

Stamp Duty payable of LLP Agreement is different from state to state and is as per the State Stamp Act. No liability to duty arises in relation to a conveyance or transfer of an interest in non-residential and non-primary production land qualifying land executed on or after 1 July 2018 subject to the conveyance or transfer of an interest not arising from a contract of sale or other transaction entered into before 1 July 2018. Rs 575000 Tax Benefits on Stamp Duty and Registration Charges in Madhya Pradesh.

HSN Code List for GST in Word. Were pleased to advise that on 1 June 2022 National Australia Bank Limited NAB acquired the consumer banking business from Citigroup Pty Ltd Citi and appointed Citi to provide transitional services. If the shares of the company are listed in a recognized stock exchange then the company cannot charge any fee for the registration of transfers of.

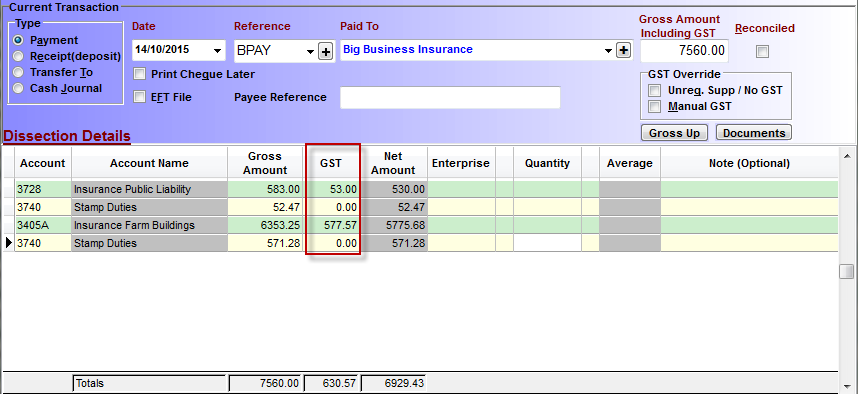

It should be for consideration. Stamp Duty in Maharashtra is a tax payable on registering a legal document with the Government. If GST is included as part of consideration stamp duty is payable on the GST inclusive amount Section 15A.

From my understanding these stamp duties imposed are related to income generating purpose. Stamp duty and registration charges in Mumbai Jun 01 2022 290623 Views. Documents that require stamp duty.

In Case Duty Exceeding Re. GST HSN Code list in Excel Format. Rate of Stamp Duty will be 0005 of the market value both for shares and debentures.

When it comes to stamp duty and registration charges the stamp duty in Maharashtra vary between 6 and 7 depending on various factors. A key finding was to increase the good and services tax GST above its current rate of 10 per cent and abolish stamp duty. Delhi section 8 companies 10.

Adhesive Stamp This is the revenue stamp that is available in the post office. GST Invoice Format Excel. Impressed Stamp For impressed stamp follow the below step by step procedure.

1 by Impressed Stamp Fixed by Proper Officer. As mentioned above a delay in the payment of stamp duty will attract a penalty of 2 every month up to 200 of the remaining amount. Adhesive Stamp upto Rs 1 only.

Buying of Land Building below the Stamp Duty Value. If a conveyance is part of a series with other conveyance documents that is the conveyances arise from a single contract of sale or together form or arise from one transaction or a series of transactions all documents must be self. Such delays in payment can make the individual liable to pay a hefty fine ranging from 2 to 200 of the total payable amount.

GST Invoice Format PDF. Stamp Duty to be paid on the consideration specified in the instrument For example SH-4 4. 25 lakhs of stamp duty.

Affix the same value stamp on a written application if the signed transfer deed has been lost. But my question is more about the stamp duty and income tax destructibility. 015 of authorised capital subject to a maximum stamp duty of rs.

In this case the board may register the transfer on specific terms of indemnity as it thinks fit. Cost of the property. Stamp duty rates differ in various states across the country as stamp duty in India is a state subject.

Stamp Duty Calculator Apr 13 2022 230300 Views. Once licensed you are required to. Item Wise GST Rates Decided on 18th June 2017 on Certain Services.

With a few exceptions a cannabis excise stamp must be present on all of your cannabis products that are available for purchase. 6-XXXX with a FRE code. GST rate on sand is fixed at five percent.

If I paid 20000 stamp duty on the purchase of a property I would probably put this to. Rs 5000000 Stamp Duty in MP 750 of propertys cost Rs 375000 Registration charges 3 of propertys cost 150000 Total amount to be paid. Where to pay Stamp Duty for share certificate.

However the central government fixes the stamp duty rates of specific instruments. The value of stamp paper on which the LLP agreement must be printed or stamp duty to be paid on the LLP agreement is dependent on the state of incorporation and amount of capital contribution from the partners. The stamp duty is to be made by the purchaser or buyer and not the seller Ask Free Legal advice.

Further bituminous or oil shale and tar sands bitumen and asphalt natural asphaltites and. GST Rate List with HSN Code All Items List.

Gst On Stamp Duty Payable On Mining Lease

Goods And Services Tax Gst In Singapore Taxation Guide

Lodha Gardenia Residences Mumbai Ad Toi Mumbai 10 10 2020 Real Estates Design Real Estate Brochures Property Ad

List Of Taxes Replaced By Gst Everything You Need To Know Abc Of Money

Gst Global Scenario More Than 140 Countries Have Already Introduced Gst National Vat France Was The First Country National Global Goods And Service Tax

What Is The Impact Of Gst Bill On Stamp Duty And Registration Charges

Indirect Tax Economics Lessons Learn Economics Economics Notes

Goods And Services Tax Definition Timeline Compliance And More

Goods And Service Tax Gst Sprout Asia

Graphic By Naveen Kumar Saini Mint Indirect Tax Economy Game Changer

Gst On Agreement Value Or On Stamp Duty Value

Gst Implications In Case Of Joint Development Agreements

Floor Plan Raunak Supreme Code Liv Large Floor Plans Large Floor Plans How To Plan

Gst On Real Estate Reduced 1 For Affordable 5 For Under Construction Real Estate Goods And Services Estates

All About Gst Composition Scheme 1 3 Turnover Limit Input Credit Returns Faq Composition Goods And Service Tax Schemes